As a business owner in South Africa, you know that offering convenient and cheap payment methods is crucial for success.

Online sales are booming, and providing your customers with a seamless and affordable payment experience is key to increasing conversions and sales.

In this blog post, we will discuss the 10 cheapest ways to accept online payments in South Africa, helping you choose the right payment solution for your business and keeping costs low.

Table of Contents

Understand Payment Gateways in South Africa

A payment gateway acts as the bridge between your online store and the payment processor.

It securely transmits customer payment information and ensures that transactions are completed smoothly.

Choosing the right payment gateway can significantly impact your costs and the customer experience.

Choosing the Best Payment Method for Your Business

Before diving into specific options, consider these factors when selecting a payment method:

- Transaction fees: Most providers charge a percentage per transaction. Compare rates to find the most affordable option.

- Setup fees: Some platforms may have initial setup costs.

- Monthly fees: Certain providers charge a recurring monthly fee.

- Accepted payment types: Ensure the method supports the payment types your customers prefer (credit/debit cards, EFT, etc.).

- Ease of integration: The simpler the integration with your e-commerce platform, the better.

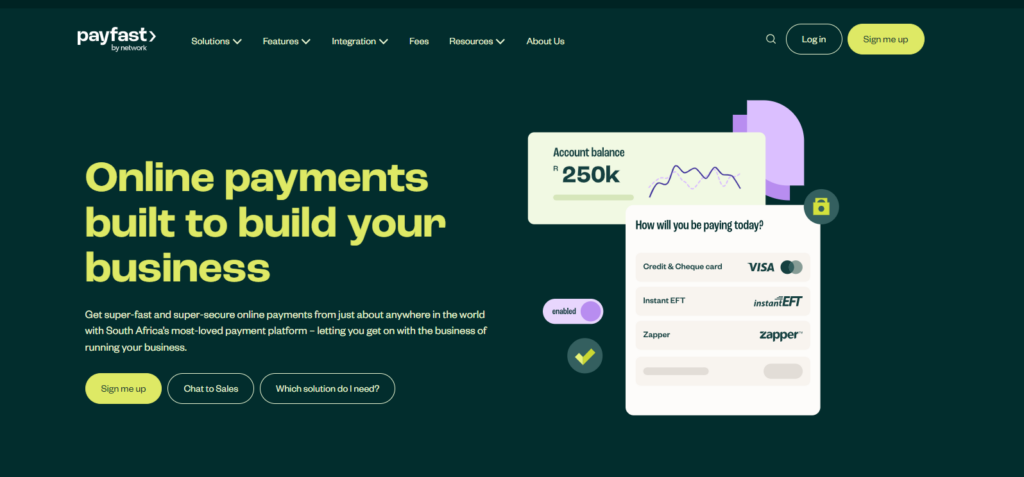

1. PayFast

PayFast is one of the most popular online payment platforms in South Africa, offering a secure and affordable way to accept payments from customers.

With PayFast, you can accept credit card and debit card payments, instant EFT, and even Bitcoin.

PayFast charges a transaction fee of 3.5% + R2 for credit and debit card transactions, and 2% for instant EFT, with no setup or monthly fees.

This makes it a cost-effective option for small businesses and startups.

PayFast also offers a range of features, including a shopping cart, subscription billing, and the ability to create payment links, making it a versatile and cheap payment solution for South African businesses.

2. PayPal

While PayPal is not as widely used in South Africa as in some other countries, it is still an option for businesses looking for a cheap way to accept online payments.

PayPal offers a basic package with no monthly fees, and transaction fees starting at 3.4% + R5.00 per transaction. PayPal is a well-known and trusted brand, and many online shoppers already have a PayPal account, making it convenient for them to pay with just a few clicks.

However, one downside is that not all South African banks support PayPal, which may limit its usefulness for some customers.

Read also: Top 5 Paypal Earning Apps in South Africa

3. Stripe

Stripe is a global payment processing platform that offers a range of features and customization options for businesses.

While Stripe is not as widely used in South Africa as PayFast, it is still an option for businesses looking for a flexible and cheap online payment solution.

Stripe’s fees are similar to PayPal, with a standard rate of 2.9% + R3.00 per transaction for South African businesses.

One advantage of Stripe is that it offers a range of developer tools and APIs, making it a good choice for businesses that want to customize their payment experience.

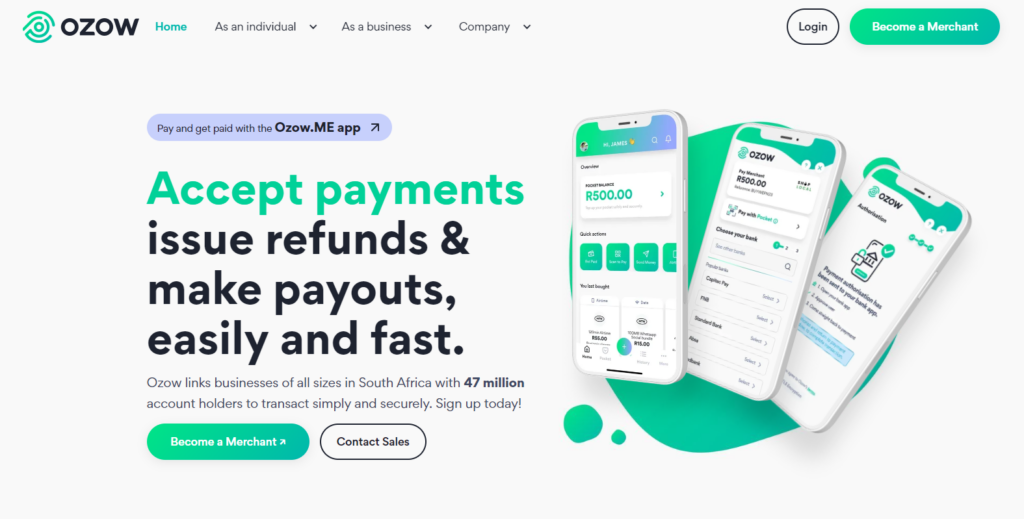

4. Ozow

Ozow is a South African payment gateway that offers a secure and affordable way to accept instant EFT payments from your customers.

With Ozow, your customers can make payments directly from their bank account, without the need for a credit or debit card. Ozow charges a flat fee of R1.00 per transaction, with no additional percentage-based fees, making it a very cost-effective option for businesses.

Ozow also offers a range of features, including a mobile payments solution and the ability to create payment links, making it a versatile and cheap payment method for South African businesses.

5. Zapper

Zapper is a mobile payment app that is widely used in South Africa for in-store and online purchases.

With Zapper, your customers can scan a QR code or enter a payment code to make a secure payment from their mobile device. Zapper charges a standard fee of 2.95% per transaction, with no additional costs for setup or monthly maintenance.

This makes it a cheap and convenient option for businesses, especially those looking to offer a mobile payment solution to their customers.

6. Bank Transfer

Accepting direct bank transfers from your customers is another cheap way to receive online payments in South Africa.

While this method may not be as convenient or instantaneous as some of the other options, it can be a cost-effective solution for small businesses and startups.

There are usually no transaction fees associated with bank transfers, although you may incur a small fee for receiving payments into your business bank account. This payment method is best suited for businesses that can wait a few days for payments to clear and that have a low volume of transactions.

7. Skrill

Skrill is an international online payment platform that is available in South Africa.

With Skrill, you can accept payments from customers all over the world, making it a good option for businesses with an international customer base.

Skrill’s fees are competitive, with a standard rate of 2.99% + R6.50 per transaction for South African businesses.

One advantage of Skrill is that it offers a range of features, including the ability to hold balances in multiple currencies and send and receive money in different countries.

8. Sage Pay

Sage Pay is a well-known payment gateway provider that offers a range of online payment solutions for South African businesses.

With Sage Pay, you can accept credit and debit card payments, as well as instant EFT and other alternative payment methods.

Sage Pay’s fees start at 2.75% + R0.99 per transaction for card payments, and they offer a range of additional features, including fraud screening and 3D Secure. Sage Pay is a good option for businesses that want a reliable and secure payment solution with a range of customization options.

9. PayGate

PayGate is another South African payment gateway that offers a range of cheap online payment options for businesses.

With PayGate, you can accept credit and debit card payments, instant EFT, and even mobile wallet payments.

PayGate’s fees are competitive, with a standard rate of 2.75% + R0.99 per transaction for card payments, and no additional costs for setup or monthly maintenance. PayGate also offers a range of value-added services, including fraud protection and recurring billing, making it a good choice for businesses looking for a feature-rich and affordable payment solution.

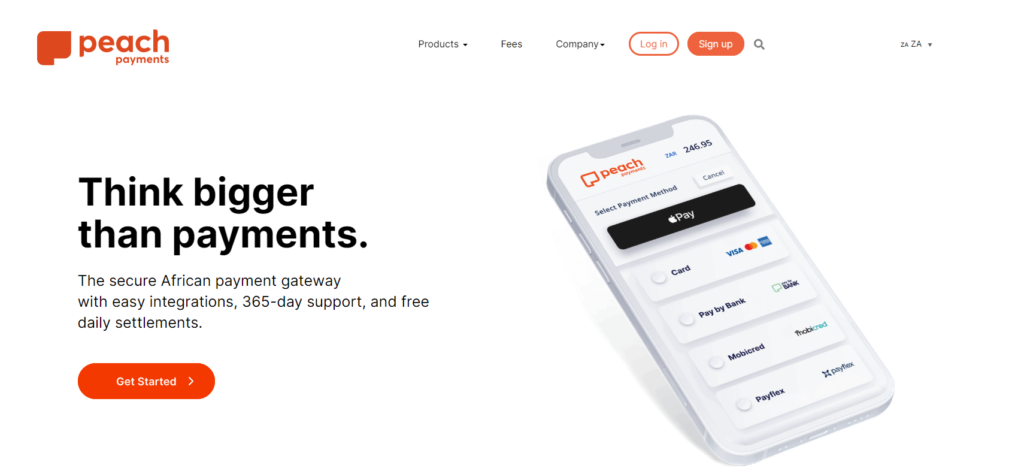

10. Peach Payments

Peach Payments is a South African online payment platform that offers a simple and cheap way for businesses to accept online payments.

With Peach Payments, you can accept credit and debit card payments, as well as instant EFT and mobile wallet payments.

Peach Payments’ fees are competitive, with a standard rate of 2.85% + R0.99 per transaction for card payments, and no additional costs for setup or monthly maintenance.

One advantage of Peach Payments is that it offers a simple and intuitive API, making it easy for developers to integrate online payment functionality into your website or app.

Choosing the Right Payment Method for Your Business

When choosing the cheapest way to accept online payments in South Africa, there are several factors to consider:

- Transaction fees: This is the percentage of each transaction that the payment provider will charge you. Look for a provider that offers low transaction fees, especially if you expect a high volume of transactions.

- Setup and monthly fees: Some payment gateways and providers charge a one-time setup fee or a monthly maintenance fee. If you are a small business or just starting, look for a provider that offers a basic package with no monthly fees.

- Supported payment methods: Consider the payment methods that are most commonly used by your target audience. For example, if your customers are mostly young and tech-savvy, they may prefer a mobile payment app like Zapper. On the other hand, if you cater to a more traditional audience, credit and debit card payments may be more appropriate.

- Integration and compatibility: Consider how easy it will be to integrate the payment solution into your existing website or ecommerce platform. Look for providers that offer plug-and-play integrations or a simple API that your developer can work with.

- Security and fraud protection: Ensure that the payment method you choose offers robust security features to protect your business and your customers’ data. Look for providers that are PCI DSS compliant and that offer additional fraud screening and protection.

Conclusion

There are several cheap ways to accept online payments for your business in South Africa, each with its own advantages and features.

When choosing a payment solution, consider the transaction fees, setup costs, supported payment methods, and integration options to find the best fit for your business.

By offering a convenient and affordable payment experience, you can increase conversions and sales, and provide your customers with a seamless way to pay for your products or services.

Read also:

Web Hosting

Web Hosting Windows HostingBuilt for Windows apps and websites – stability, speed and flexibility

Windows HostingBuilt for Windows apps and websites – stability, speed and flexibility Reseller HostingLaunch a hosting business without technical skills or expensive infrastructure

Reseller HostingLaunch a hosting business without technical skills or expensive infrastructure Affiliate ProgramRefer customers and earn commissions from sales across our platform

Affiliate ProgramRefer customers and earn commissions from sales across our platform Domain SearchFind and secure a domain name in seconds with our quick lookup tool

Domain SearchFind and secure a domain name in seconds with our quick lookup tool CO ZA Domains

CO ZA Domains All DomainsExplore domain names from over 324 TLDs globally – all in one place

All DomainsExplore domain names from over 324 TLDs globally – all in one place Free Whois Lookup Tool South Africa

Free Whois Lookup Tool South Africa VPS

VPS SSLs

SSLs